About Platinum

Platinum is a rare precious metal valued for its scarcity, strong industrial demand, and long-term price potential. While platinum reached major highs during the 2008 commodities cycle, its all-time record price occurred in 2025, when platinum surpassed $2,400 USD per ounce amid tight global supply and renewed demand.

Platinum prices are influenced by the live spot market, mining concentration in South Africa and Russia, and several key demand sectors. The automotive industry remains the single largest source of demand, typically accounting for roughly 30–40% of global platinum consumption. Platinum is a critical component in catalytic converters for internal combustion and hybrid vehicles.

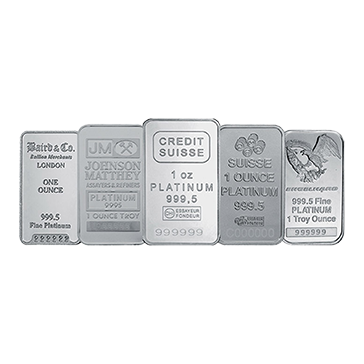

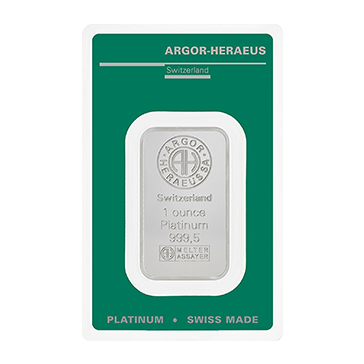

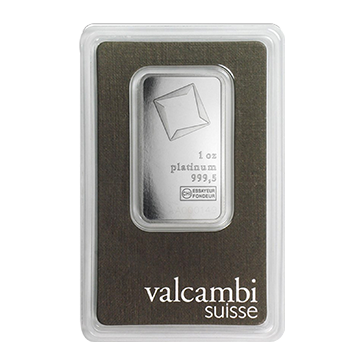

Platinum plays an expanding role in the hydrogen economy, where it is considered a critical metal. Platinum catalysts are used in PEM electrolyzers for green hydrogen production and in fuel cell vehicles, particularly hydrogen-powered trucks and buses. Industrial and medical applications also represent a significant share of demand, including glass manufacturing, chemical catalysts, electronics, and healthcare, where platinum’s high melting point, durability, and biocompatibility are essential. Jewelry and investment demand remain important components of the platinum market. Physical platinum bars and coins are also increasingly sought by investors looking for tangible exposure to a metal with limited above-ground supply.

Kitco offers a full range of .999 fine platinum bars and platinum coins from trusted private and government mints, available for fully insured delivery or secure non-bank storage. With its high density, corrosion resistance, and constrained supply, physical platinum bullion remains a distinctive and durable precious metal choice."