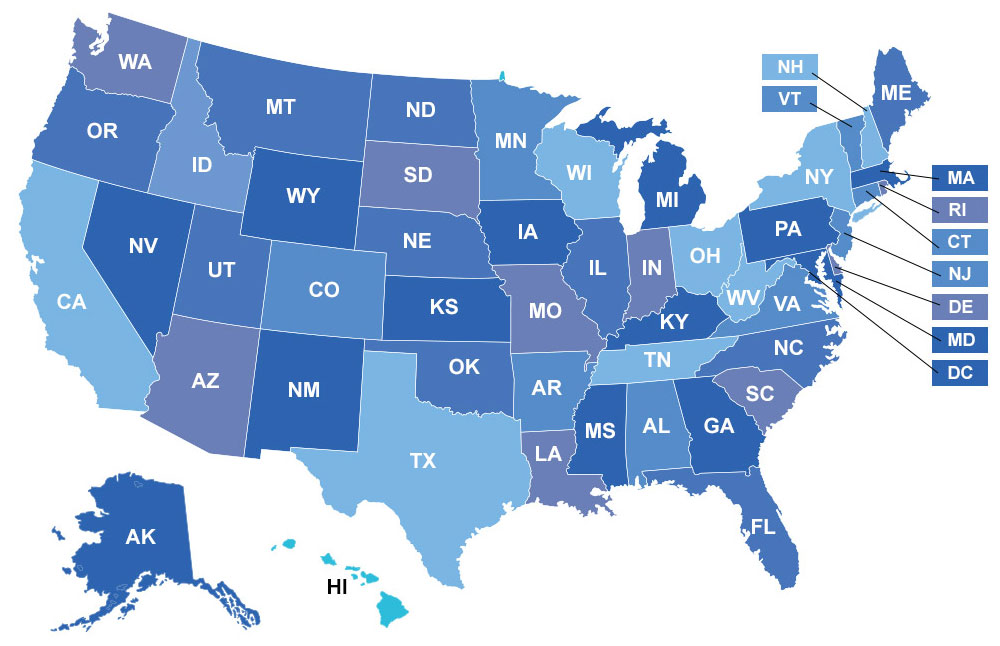

On June 21, 2018, the Supreme Court of the United States announced a decision in the "South Dakota vs. Wayfair Inc." Case where it was argued that the state was losing out on local sales taxes as consumers were buying more and more online rather than going to the local stores. A precedent was set years ago (1992) where if the online retailer had no presence in the state, no local taxes needed to be collected. This time, the Court ruled in favor of South Dakota, creating a new precedent for all US states to force online retailers to collect and remit local sales taxes.

At Kitco, we are adapting to these new regulations and working hard to make this change as easy and transparent as possible for you. We have created this page for you to see how much tax would you be charged depending on the products you purchase and the delivery address of your order (please note taxes are charged based on the state the delivery address is, not your phyisical address).

If you have any more questions, we recommend you to contact your tax advisor/proffesional.

Alabama

Alabama requires the collection of a flat-rate tax (called Simplified Sellers Use Tax) on some of the products sold by Kitco which are delivered to any address in the state of Alabama.

These taxes are to be collected on:

- Copper products

- Certain bullion items less than .90 fine

- Certain numismatic products

- Foreign or non-circulating coins

- Accessories

- Processed items

- All Palladium and Rhodium products

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: R011300800

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Alabama. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Alaska

Alaska doesn't require the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Alaska.

Kitco Metals Inc. program account number: 008414

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Alaska. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Arizona

Arizona requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Arizona.

These taxes are to be collected on:

- Copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 21398301

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Arizona. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Arkansas

Arkansas requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Arkansas.

These taxes are to be collected on:

- Copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 54531459-SLS

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Arkansas. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

California

California requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of California.

These taxes are to be collected on:

- Bullion made from copper, platinum, or palladium

- Gold and Silver coins (bullion and numismatic), rounds or bars, if the total amount of a single sales transaction is less than USD$2000

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 78-8018859036-5

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of California. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Colorado

Colorado requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Colorado.

These taxes are to be collected on:

- Copper products

- Some numismatic products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 33820756

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Colorado. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Connecticut

Connecticut requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Connecticut.

These taxes are to be collected on:

- Platinum, palladium, and copper products

- Some numismatic coins

- Accessories

- Processed items

- Any gold and silver products for which the sales transaction amount is less than USD$1,000

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 78462868001

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Connecticut. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

District of Columbia

District of Columbia requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the District of Columbia.

Kitco Metals Inc. program account number: 350-001594432

Please note: The above is not a comprehensive description of sales tax laws and requirements in the District of Columbia. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this district that relate to the reader's transactions with Kitco.

Florida

Florida requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Florida.

These taxes are to be collected on:

- Copper products

- Bullion coins minted other than US that total order value less than $500.00

- Platinum and Palladium Bullion

- Accessories

- Processed items

Kitco Metals Inc. program account number: 78-8018859036-5

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Florida. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Georgia

Georgia requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Georgia.

These taxes are to be collected on:

- Palladium products

- Copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 175926624

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Georgia. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Hawaii

Hawaii requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state/islands of Hawaii.

Kitco Metals Inc. program account number: GE-102-372-8128-01

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state/islands of Hawaii. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Idaho

Idaho requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Idaho.

These taxes are to be collected on:

- copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 005229741

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Idaho. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Illinois

Illinois requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Illinois.

These taxes are to be collected on:

- Palladium products

- Copper products

- Bullion whose purity is less than .980 fine

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 4323-5301

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Illinois. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Indiana

Indiana requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Indiana.

These taxes are to be collected on:

- Copper products

- Gold bullion (bars, coins, and rounds) whose purity is less than .995 fine

- Silver bullion (bars, coins, and rounds) whose purity is less than .999 fine

- Platinum bullion (bars, coins, and rounds) whose purity is less than .9995 fine

- Palladium bullion (bars, coins, and rounds) whose purity is less than .9995 fine

- Coins not considered "American Eagles (proof or not)", or coins not issued under the law of the United States

- Numismatic coins

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 0166984710

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Indiana. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Iowa

Iowa requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Iowa.

Kitco Metals Inc. program account number: 200183466

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Iowa. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Kansas

Kansas requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Kansas.

These taxes are to be collected on:

- Bullion made from copper, palladium, or rhodium

- All coins except those made of gold or silver

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 005-XXXXX0129F-01

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Kansas. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Kentucky

Kentucky requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Kentucky.

Kitco Metals Inc. program account number: 000829005

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Kentucky. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Louisiana

Louisiana requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Louisiana.

These taxes are to be collected on:

- Bullion products made of palladium or copper

- Coins made of copper, platinum, or palladium (unless they have a numismatic value)

- Any gold, silver, or platinum products for which the sales transaction amount is less than USD$1,000

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 2455159-001

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Louisiana. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Maine

Maine requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Maine.

Kitco Metals Inc. program account number: 1199860

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Maine. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Maryland

Maryland requires the collection of sales taxes on all the products sold by Kitco which are delivered to any address in the state of Maryland.

Kitco Metals Inc. program account number: 17634098

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Maryland. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Massachusetts

Massachusetts requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Massachusetts.

These taxes are to be collected on:

- Any copper, platinum, or palladium products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: SLS-19794622-003

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Massachusetts. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Michigan

Michigan requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Michigan.

These taxes are to be collected on:

- Copper products

- Palladium products

- Gold, silver, or platinum bullion product with purity less than .900

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 98-1470129

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Michigan. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Minnesota

Minnesota requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Minnesota.

These taxes are to be collected on:

- Copper products

- All coins

- Bullion that does not meet certain purity requirements

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 6131421

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Minnesota. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Mississippi

Mississippi requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Mississippi.

Kitco Metals Inc. program account number: 1409-1100

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Mississippi. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Missouri

Missouri requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Missouri.

These taxes are to be collected on:

- Copper products

- Products that are not smelted or refined

- Coins that do not have a value beyond their statutory or nominal value

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 27682935

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Missouri. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Nebraska

Nebraska requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Nebraska.

These taxes are to be collected on:

- Copper products

- Coins that are not or were not used as legal tender

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 14406187

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Nebraska. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Nevada

Nevada requires the collection of sales taxes on all the products sold by Kitco which are delivered to any address in the state of Nevada.

Kitco Metals Inc. program account number: 1041193424

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Nevada. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

New Jersey

New Jersey requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of New Jersey.

These taxes are to be collected on:

- Copper products

- The individual bullion coin that has a fair market value of less than $1,000.00

- Accessories

- Processed items

Kitco Metals Inc. program account number: 98-1470129

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of New Jersey. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

New Mexico

New Mexico requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of New Mexico.

Kitco Metals Inc. program account number: 03568995001-GRT

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of New Mexico. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

New York

New York requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of New York.

These taxes are to be collected on:

- Copper products

- Gold, silver, platinum, or palladium products for which the sales transaction amount is less than USD$1,000

- Gold, silver, platinum, or palladium products for which the sales transaction amount is more than USD$1,000 and one of the following applies:

- a) For Silver coins, sales price for that specific is greater than or equal to 140% of the silver value of the coin

- b) For Gold Coins with 1/4 ounce or less of Gold in the specific coin, if the sales price of the specific coin is greater than or equal to 120% of the gold value of that coin

- c) For gold coins with more than 1/4 ounce of gold in the specific coin, if the sales price of the specific coin is greater or equal to 115% of the gold value of that coin

- d) For platinum or palladium coins, if the sales price for the specific coin is greater than or equal to 115% of the platinum or palladium value in the coin

- e) For bars, ingots, wafers, or any other form in gold, silver, platinum, or palladium, if the sales price of the specific item is greater than or equal to 115% of the precious metal value in the specific item.

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 98-1470129

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of New York. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

North Carolina

North Carolina requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of North Carolina.

These taxes are to be collected on:

- Copper products

- Products that are not smelted or refined

- Coins that do not have a value beyond their statutory or nominal value

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 003420552

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of North Carolina. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

North Dakota

North Dakota requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of North Dakota.

These taxes are to be collected on:

- Copper products

- Numismatic coins

- Bullion that does not meet certain purity requirements

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 348067 00

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of North Dakota. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Ohio

Ohio requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Ohio.

These taxes are to be collected on:

- All Palladium and Rhodium bullion products

- Copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 99-127677

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Ohio. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Oklahoma

Oklahoma requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Oklahoma.

These taxes are to be collected on:

- Copper products

- Coins that are not currently, or were not previously, used as legal tender in the United States or any foreign country

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: SVU-15163691-02

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Oklahoma. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Pennsylvania

Pennsylvania requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Pennsylvania.

These taxes are to be collected on:

- Copper products

- Coins that are not currently, or were not previously, used as legal tender in the United States or any foreign country

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 67651616

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Pennsylvania. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Rhode Island

Rhode Island requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Rhode Island.

These taxes are to be collected on:

- Copper products

- Bullion products that are not melted or refined

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 209673825

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Rhode Island. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

South Carolina

South Carolina requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of South Carolina.

These taxes are to be collected on:

- Copper and palladium products

- Coins that are not currently, or were not previously, used as legal tender in the United States or any foreign jurisdiction

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 101637846

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of South Carolina. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

South Dakota

South Dakota requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of South Dakota.

These taxes are to be collected on:

- Copper products

- Numismatic coins

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 1037-9640-ST

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of South Dakota. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Tennessee

Tennessee requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Tennessee.

These taxes are to be collected on:

- Copper products

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 1001206229

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Tennessee. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Texas

Texas requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Texas.

These taxes are to be collected on:

- Copper and palladium bullion products

- Copper and palladium bullion coins

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 3-20709-4927-9

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Texas. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Utah

Utah requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Utah.

These taxes are to be collected on:

- Copper and palladium products

- Bullion products made of gold, silver, or platinum if the gold, silver, or platinum content of such product is less than 50%

- Numismatic coins unless such numismatic coins are also used as legal tender

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 14859474-003-STC

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Utah. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Vermont

Vermont requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of Vermont.

Kitco Metals Inc. program account number: SUT-11013384

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Vermont. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Virginia

Virginia requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Virginia.

These taxes are to be collected on:

- Copper and palladium bullion products

- Coins that are mediums of exchange if the sale price of a single sales transaction is less than $1,000

- Numismatic coins that can't be used as a medium of exchange and if the sale price of a single sales transaction is less than $1,000

- Gold, silver, or platinum bullion if the sale price of a single sales transaction is less than $1,000

- Gold, silver, or platinum bullion if such metals have not gone through a refining process

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 12-981470129F-001

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Virginia. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Washington

Washington requires the collection of sales taxes on all products sold by Kitco which are delivered to any address in the state of Washington.

Kitco Metals Inc. program account number: 604-460-554

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Washington. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

West Virginia

West Virginia requires the collection of sales taxes on all of the products sold by Kitco which are delivered to any address in the state of West Virginia.

Kitco Metals Inc. program account number: 2376-9338

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of West Virginia. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Wisconsin

Wisconsin requires the collection of sales tax on all products sold by Kitco that are delivered to an address within the state.

In March 2024, Wisconsin passed a law exempting gold, silver, coins, and bullion from sales tax. Keep in mind, some rules do affect how the exemptions are handled.

Why Am I Still Paying Sales Tax?

The Wisconsin Department of Revenue introduced a new rule (Administrative Code 11.78) that affects how this exemption is applied.

- If your order is shipped to a Wisconsin address, it's considered an in-state sale — and gets taxed.

- Only purchases made in person, outside Wisconsin, are tax-free.

Who May Qualify for Exemption?

You might still qualify for the exemption if you:

- Are a reseller or qualifying business placing an order through a Kitco Business Account

- Can provide a valid Wisconsin Certificate of Exemption with valid reason

Reminder: You can't use Wisconsin's sales tax exemption for precious metals as the reason on a Certificate of Exemption. It doesn't apply for that purpose.

More Sales Tax Details

Due to this rule, Kitco is required to collect sales tax on all orders delivered to Wisconsin.

For reference, here is our Wisconsin program account number: 456-1029923909-02

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Wisconsin. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.

Wyoming

Wyoming requires the collection of sales taxes on some of the products sold by Kitco which are delivered to any address in the state of Wyoming.

These taxes are to be collected on:

- Coins that have gold or silver content but are not recognized as mediums of exchange for the payment of debts and taxes

- Coins made of platinum, palladium, or copper

- Bullion products that are not coins

- Accessories

- Processed items

All other products sold by Kitco are exempt from these taxes.

Kitco Metals Inc. program account number: 24049206

Please note: The above is not a comprehensive description of sales tax laws and requirements in the state of Wyoming. It is only intended to provide the reader with a brief overview of those sales tax laws and requirements currently in effect in this state that relate to the reader's transactions with Kitco.